Stamp Duty Calculator. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

What Is A Trust Deed And Why Is It Important

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

. Visualize the monthly instalment legal fees and stamp duties for buying a house in Malaysia. Or you can use Tenancy Agreement Stamp Duty Calculator Malaysia to Calculate. So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself.

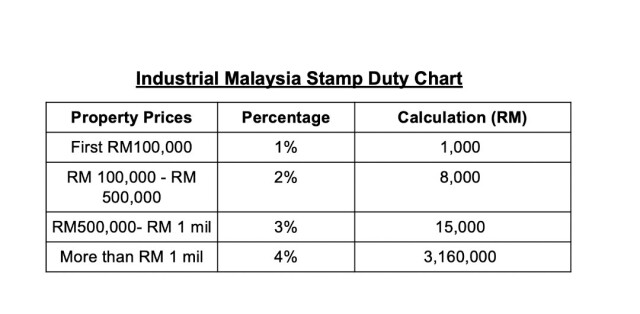

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. For First RM100000 RM100000 Stamp duty Fee 2. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef.

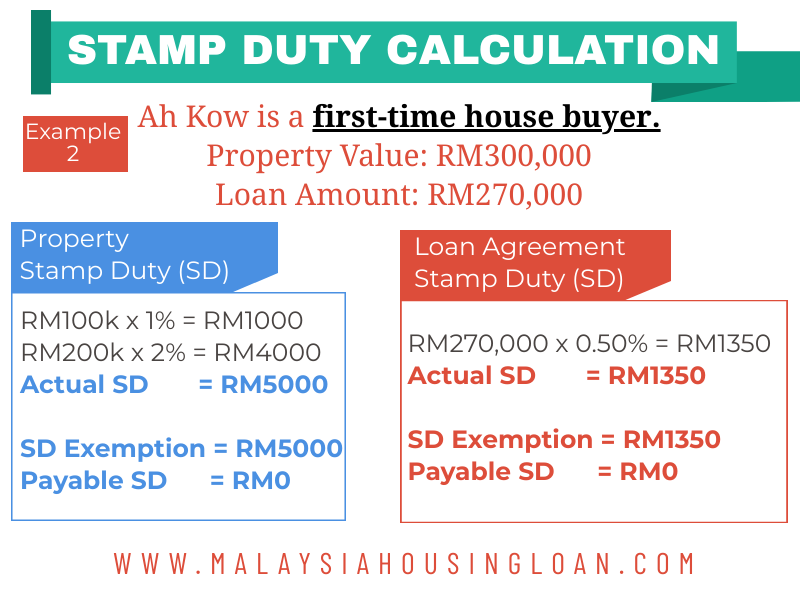

Please note that the above formula merely provides estimated stamp duty. Sign-up For The Newsletter. If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500.

The actual stamp duty will be rounded up according to the Stamp Act. SPA Stamp Duty. It is required to be stamped within 30 days of the date of tenancy agreement execution or the landlord may risk penalties.

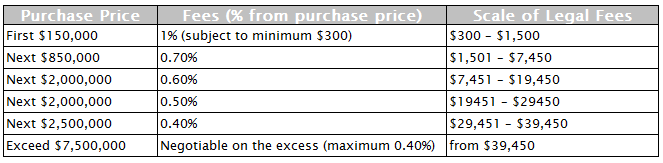

Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. 100 loan is possible but uncommon for most people. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

Android 1 asialah 4 Bootstrap 8. Admin Fee Amount RM1000. The exemption applies for a maximum loan amount of RM300000.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Calculator - For Malaysia Sale and Purchase Agreement legal fee loan fee and stamp duty of property. For Job Application please email your Resume to -.

Stamp duty Fee 1. - Stamp duty exemption is capped at RM300000 on the property market value and loan amount. Service Agreements and Loan Agreements.

This is applicable for all residential property purchases up to RM 500000 from 1 January 2021 to 31 December 2025. Loan Documentation Stamp Duty. The loan agreement Stamp Duty is 050 from the loan amount.

The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. You dont need a loan stamp duty calculator to calculate this. The loan agreement Stamp Duty is 050 from the loan amount.

Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia. Please note that the above formula merely provides estimated stamp duty. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Stamp Duty Legal Fees Online Calculator High Court Location Map. Check out our up-to-date Home Loan and Home Refinance comparison tools. The following powerful calculator is designed for public to estimate the legal fees and stamp duty incurred when they are buying any property in the state of Sabah.

Legal Fees Stamp Duty Calculator For Sale PurchaseSP And Loan Agreement. This calculator calculates the estimated or approximate fees needed for Stamp duty on Memorandum of Transfer MOT. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400.

The exemption applies for a maximum loan amount of RM500000. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments.

Stamp Duty is a tax on Tenancy Agreement imposed by LHDN Malaysia. The calculations done by this calculator is an estimation of Stamp Duty on MOT of house purchase in Malaysia it gives you an idea how much money you. Loan Sum - 300000 X 05 The Property Price greater than RM500000.

Calculate now and get free quotation. Please contact us for a quotation for services required. More tha RM 100000.

Stamp duty is calculated based on every RM250 of annual rental and rounded up to the nearest multiple of RM250 and the rate varies RM1-4 depending on. Loan Documentation Legal Fees. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Stamp Duty Legal Fees Calculator. The copyright to the. Total RM Grand Total RM The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law.

Just use your physical calculator. 603-4280 6202 Email. Stamp duty is a tax on legal documents in Malaysia.

Legal fee Stamp duty online calculator. The stamp duty is free if the annual rental is below RM2400. And intended for educational or reference purposes only as such it should.

We have made. Just use your physical calculator. Check Out Singapore Rental Stamp Duty Calculator Here.

Shares or stock listed on Bursa Malaysia. If the loan amount is RM300000 the stamp duty for the loan agreement is RM300000 x 050 RM1500. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

Best Calculator for Property Stamp Duty Legal Fees in Malaysia Free. Property Selling Price Market Value whichever is higher. FREE PS Wong Co Legal Fees and Stamp Duty Calculator 609-290 9323 609-290 2641.

FORMULA Loan Sum x 05. You dont need a loan stamp duty calculator to calculate this. On 6 November 2020 the Malaysian Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz announced that for first-time home buyers there will be exemptions on the stamp duty for the MOT and loan agreements.

All you need is all HERE. The actual stamp duty will be rounded up according to the Stamp Act. ENGLISH BAHASA MALAYSIA.

Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan. Loan Sum x 05 Note. This website belongs to GTRZ.

Malaysia Property Legal Fees and Stamp Duty Calculator. To know the exact stamp duty you need to pay you can visit our free stamping fee calculator. The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by Sabahs law.

Stamp duty of 05 on the value of the services loans. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house. Home Stamp Duty Legal Fees Calculator.

Stamp Duty - Loan. Property Price RM. Web design maintainance by.

You will get a full summary after clicking Calculate button.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Mot Calculation 2020 Property Paris Star

Sheldon Property Malaysia Property Stamp Duty Calculation Facebook By Sheldon Property

Pin On Malaysia Property Info 地产资讯

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Budget 2019 Property And Housing Summary Malaysia Housing Loan

Know The Transaction Costs And Taxes When Buying Property Overseas Transaction Cost Buying Property Cost

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Mot Calculation 2020 Property Paris Star

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Buying Property And Stamp Duty Planning Action Real Estate Valuers

Know The Transaction Costs And Taxes When Buying Property Overseas Transaction Cost Buying Property Cost

Sme Corporation Malaysia Stamp Duty Rate